How can we help you?

'' did not bring up any results.

Popular searches

Activate a FAB card

Contact Center

Credit Cards

In-Branch Digital Services

Mobile Banking

Historical profit rates distribution:

| Islamic account type & CCY |

Profit Rate Distributed (May’22) |

Profit Rate Distributed (Jun’22) |

Profit Rate Distributed (Jul’22) |

|---|---|---|---|

|

Islamic Savings – AED |

0.50% |

0.50% |

0.50% |

|

Islamic Savings – USD |

0.50% |

0.50% |

0.50% |

|

Islamic Savings – EUR |

0.50% |

0.50% |

0.50% |

|

Islamic Savings – GBP |

0.50% |

0.50% |

0.50% |

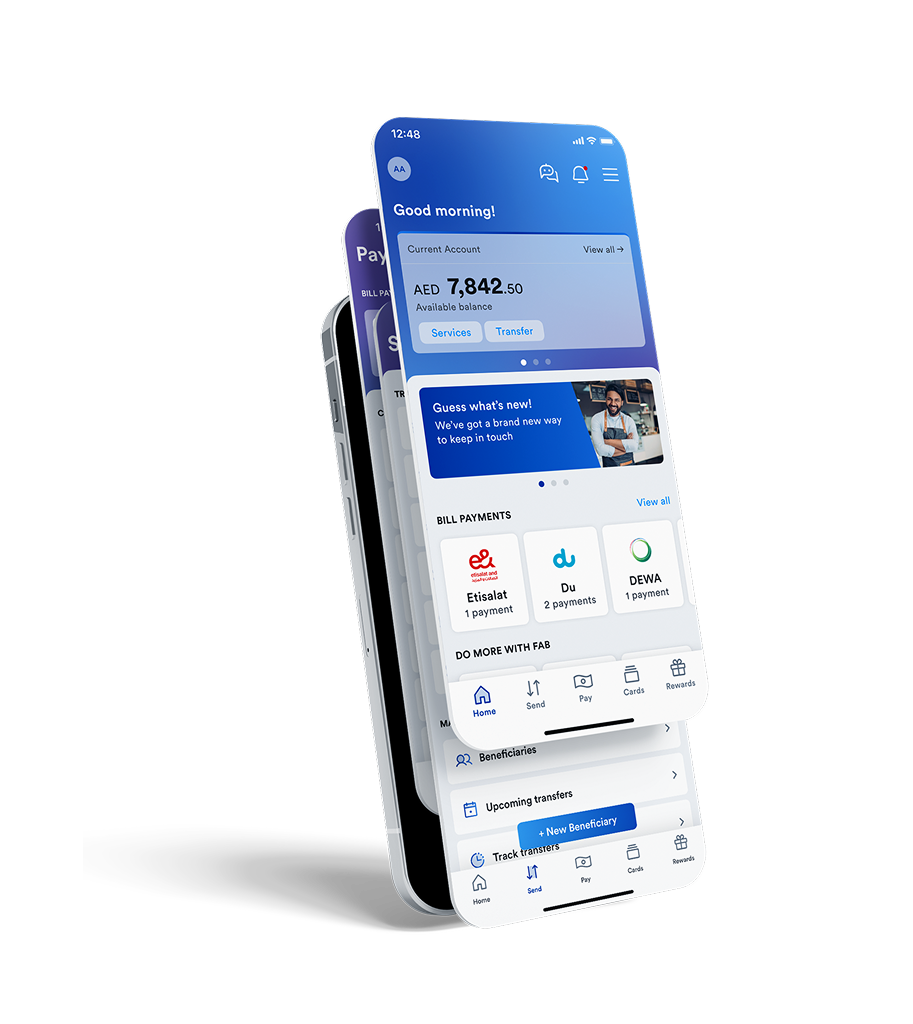

FAB Mobile puts the power of the bank in your hands

Contact us anytime for further assistance or check out our FAQ page for more information.

| FAB Islamic | International | ||

|---|---|---|---|

|

800 2200 Lines Open 24/7 |

+971 2 499 6299 | ||

| Email Us | |

|---|---|

| islamiccustomercare@bankfab.com | |