How can we help you?

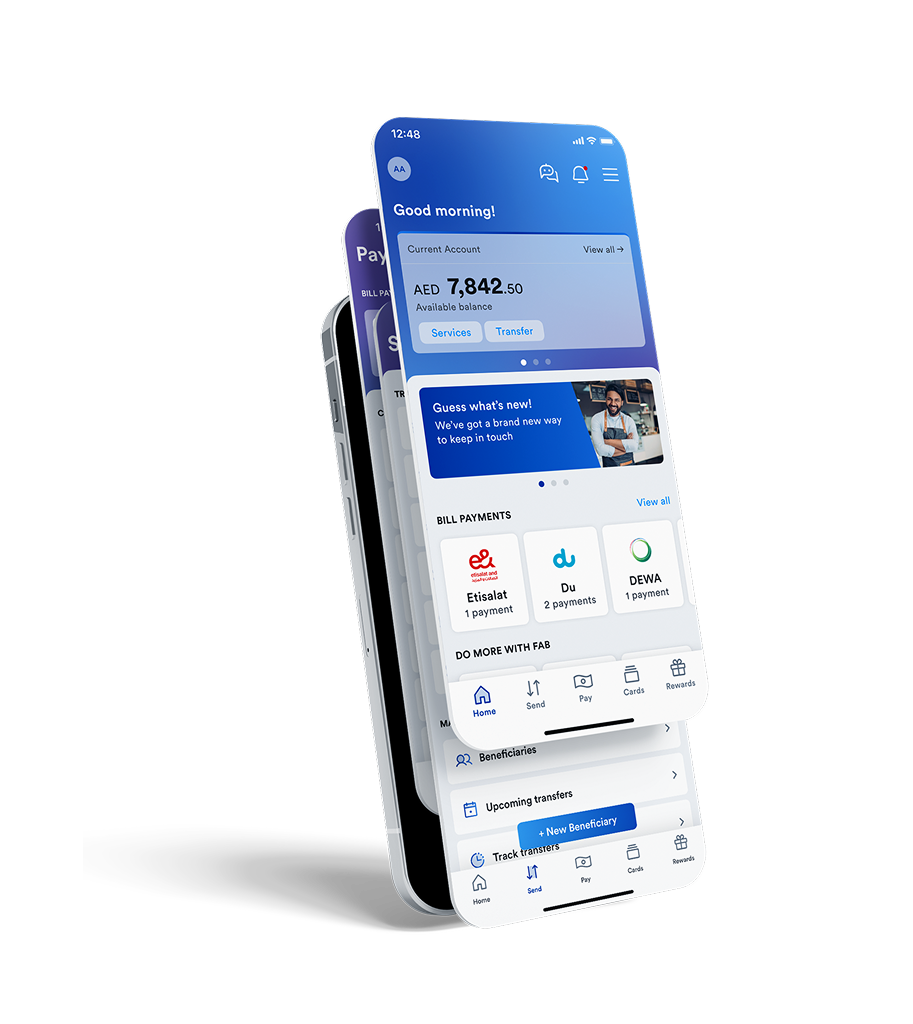

Whether it’s a one-time transfer or a recurring transfer, you can set it up easily and conveniently on FAB Mobile, in just a few steps. Let’s show you how.

It doesn’t have to take hours to spread happiness to your loved ones. With FAB Mobile, your family back home can receive the money just as soon as you send it. You can transfer money either directly to a bank account, or to a mobile wallet.

Currently, instant transfers are available to India, Pakistan, Philippines, Sri Lanka, UK and EU.

Transfer up to AED 100,000 within the UAE from your FAB Bank account:

Requests submitted before 4 p.m. on a working day will be processed the same day.

Any requests submitted after 4 p.m, or on a bank holiday, will be processed on the next working day

Transfer up to € 21,000 per transaction within 60 minutes to any of the 23 countries* in the Eurozone from your FAB account:

| * Countries in the Eurozone enabled for Instant Transfers: | ||||

|---|---|---|---|---|

| Andorra | Greece | Netherlands | ||

| Austria | Ireland | Portugal | ||

| Belgium | Italy | San Marino | ||

| Cyprus | Latvia | Spain | ||

| Estonia | Lithuania | Slovak Republic | ||

| France | Luxembourg | Slovenia | ||

| Finland | Malta | Vatican City | ||

| Germany | Monaco | |||

Transfer up to GBP 18,000 per transaction within 60 minutes to any bank account in the United Kingdom from your FAB account:

Transfer up to INR 1,500,000 per transaction within 60 minutes from your FAB Bank account:

Transfer up to PKR 1,500,000 per transaction within 60 minutes from your FAB Bank account:

Transfer up to PHP 500,000 per transaction within 60 minutes from your FAB Bank account:

Transfer up to LKR 4,250,000 per transaction within 60 minutes from your FAB Bank account:

Digital Wallet Name: Jazz Cash

Digital Wallet Name: GCash

Digital Wallet Name: eZ Cash

The provision of this service is subject to the terms and conditions set out in First Abu Dhabi Bank PJSC - General Terms and Conditions for Accounts.

FAB Mobile puts the power of the bank in your hands

Contact us anytime for further assistance or check out our FAQ page for more information.

| For customers within the UAE | For customers outside of the UAE | ||

|---|---|---|---|

| 600 52 5500 | +971 2 681 1511 | ||